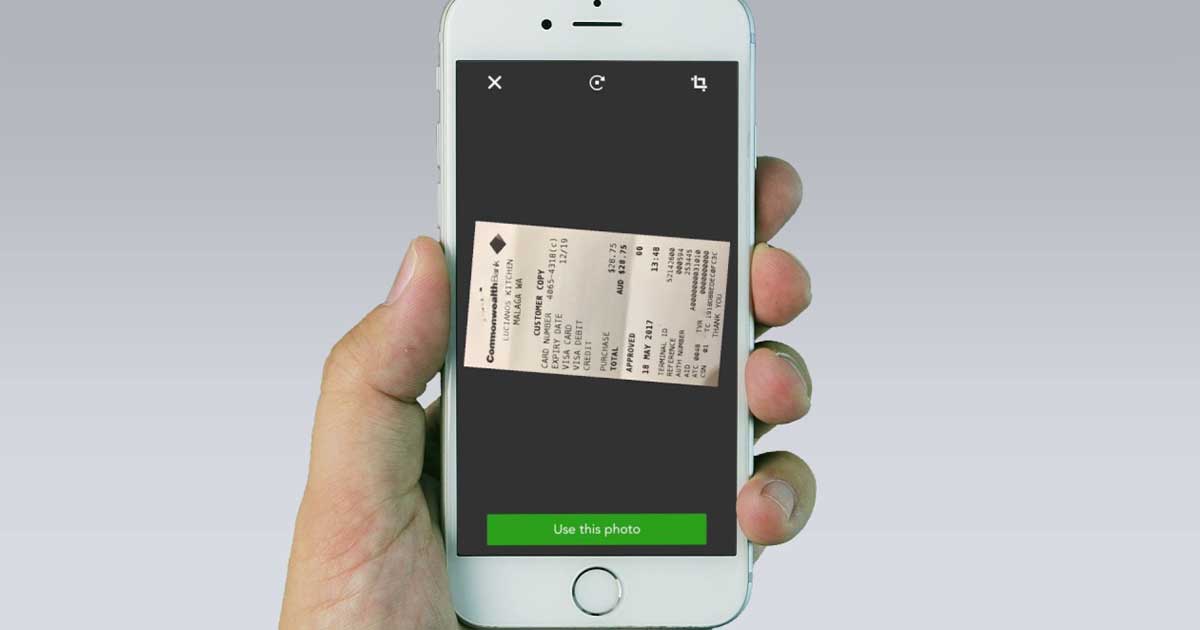

For all subscription levels of QuickBooks® Online you can now capture receipts. It is also possible to attach receipts in QuickBooks® Desktop.

Why is it necessary to capture receipts?

The Internal Revenue Service requires receipts since they state the amount, date, place and nature of the expense. Should you be chosen for an audit two years later, the receipt is already attached to the bill/expense. So no need to panic looking for it.

If you need help in capturing receipts in QuickBooks® Online or QuickBooks® Desktop, please call Susan @ 630.523.5762.